Ris used everywhere espically in Data Science. As Part of our Time Series Analysis and Forecasting Course, our mentor Dr.Prashobhan Palakkeel has given an assignment to do an Exponential Smoothing and ARIMA to analysis a TimeSeries data. I will be explaining the results that I have got.

About the Dataset

I have used the Dataset “HBS Table No.163 Components of Money Stock”. The Series that I have used from the dataset is, “Currency in Circulation”. I have used Exponential smoothing technique and ARIMA methods for modelling and forecasting. I have included the R code that I have used for forecasting and the outputs of each model and comparison between both models.

Analysis of Dataset

The First process after downloading the data set is to read the dataset in R. The Series “Currency in Circulation” has been copied to clipboard. The below R code reads the data from the clipboard and stores it in the variable currency_in_circulation_data.

currency_in_circulation_data <- read.delim('clipboard', header = FALSE)

currency_in_circulation_data

After Reading, I have converted the data to vector.

vec <- as.vector(t(currency_in_circulation_data))

vecThe Vector data has been reversed because, the data in the dataset starts from 2022-23 and ends in 1991-92. The Data should start from 1991-92 and end in 2022-23. To achieve this, the data is been reversed using the rev() function in R.

rev_currency_in_circulation_data <- rev(vec)

rev_currency_in_circulation_dataWe are converting the reversed vector data which is stored in the variable rev_currency_in_circulation_data into a timeseries data. The Start year will be 1992 - April Month and ends in 2023 - August Month. The Frequency is 12 because, number of months is 12.

data_ts <- ts(rev_currency_in_circulation_data, start = c(1992,4), end= c(2023,8) ,frequency = 12)

data_tsPlotting the TimeSeries data

plot(data_ts)

boxplot(data_ts)

boxplot.stats(data_ts)Decomposition of time series data

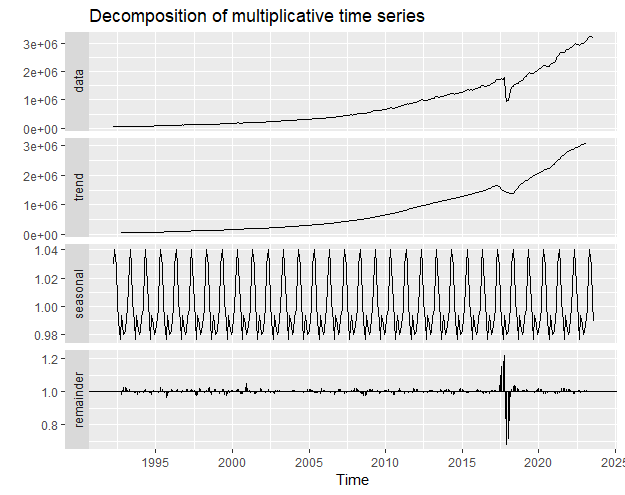

decom <- decompose(data_ts, "multiplicative")

autoplot(decom)

Check if the Data is Stationary using KPSS Test. Stationary if the value is test static value is < critical value

#KPSS TEST

library(urca) #Assumption that, H0 is <- Data is stationary.

summary(ur.kpss(data_ts))

ndiffs(data_ts) #Number of time we have to diff to make the data stationary.

data_diff <- diff(data_ts, 2) #making the data stationary.

#testing if it become stationary

summary(ur.kpss(data_diff))Output Screenshots

Reversed Vector

Time Series Data

TimeSeries plot

Decomposition of time series data

KPSS Unit Test

TimeSeries boxplot

Modelling and forecasting the given time series using the Exponential Smoothing Method

Simple Exponential Smoothing

ot_ses <-ses(data_ts, h=6)

ot_ses #Printing the forecast

summary(ot_ses[["model"]])

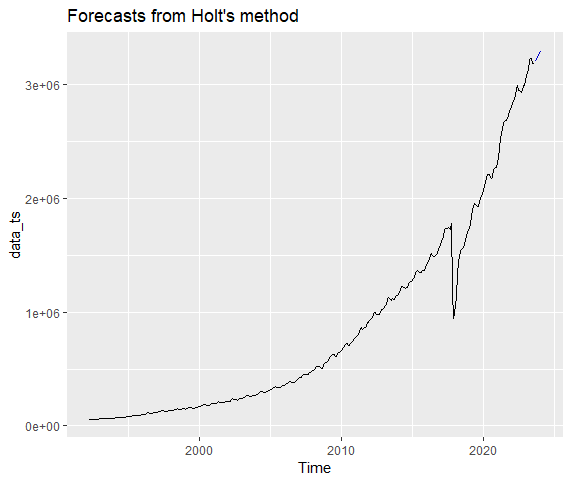

autoplot(ot_ses)Holt's Method

ot_holt <- holt(data_ts, h=6, PI=FALSE)

ot_holt #Printing the forecast

summary(ot_holt[["model"]]) #Summary of Holt's Method

autoplot(ot_holt) #Plotting the Forecast from Holt's Exponential Smoothing.Holt's Winter Seasonal Method

fit1 <- hw(data_ts, seasonal = "additive")

fit2 <- hw(data_ts, seasonal = "multiplicative")

autoplot(fit1)

autoplot(fit2)

#Forecasting for next 100 months using Holt's Winter Method

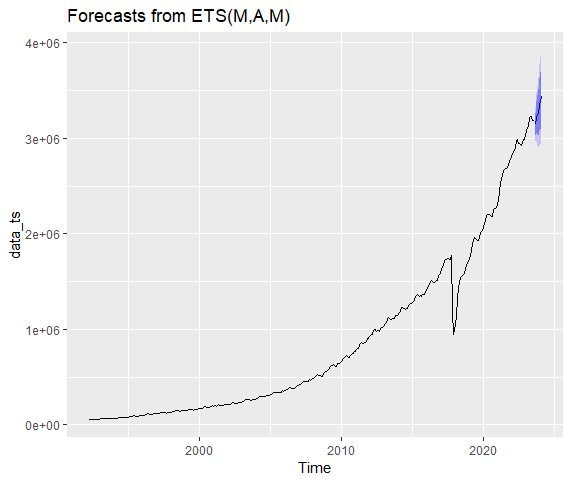

ot_forecast_holtWinter <- forecast(ets(data_ts, model="AAA"), h=6)

ot_forecast_holtWinter #Printing the forecast

summary(ot_forecast_holtWinter[["model"]]) #Summary of Holt's Winter Method

autoplot(ot_forecast_holtWinter) #Plotting the ForecastOutput Screenshots of Exponential Smoothing Method

Summary of Simple Exponential Smoothing

Plot of Forecasts from Simple Exponential Smoothing

Summary of Holt's Method

Plot of Forecasts from Holt's Method

Summary of Holt's Winter Method

Plot of Forecasts from Holt's Winter Method

Modelling and forecasting the given time series using the ARIMA method

ARIMA model for exponential series

ot_arima <- auto.arima(data_ts, trace = TRUE)

ot_arima

#Forecasting using arima - Next 100 Values

ot_forecast_arima <- forecast(ot_arima, 100)

ot_forecast_arima #Printing the Forecast

autoplot(ot_forecast_arima) #Plotting the Forecast

Augmented Dickey-Fuller Test

data_ts %>% autoplot()

data_ts %>% log() %>% autoplot()

data_ts %>% log() %>% diff %>% autoplot()

data_ts %>% log() %>% diff(lag=12) %>% autoplot()

data_ts %>% log() %>% diff -> prabhu_dif

#Augmented Dickey-Fuller Test

adfTest(prabhu_dif)

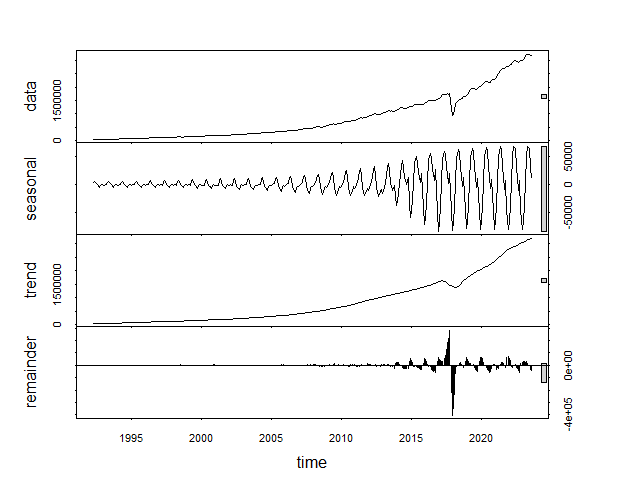

plot(stl(data_ts, s.window = 13))

AUTO-ARIMA model

fit <- auto.arima(data_diff)

fit

acf(data_diff, lag.max = 100)

pacf(data_diff, lag.max=20)

ts.plot(data_diff)

#Plotting the forecasts from arima

ot_arima_forecast <- forecast(fit, h=6)

ot_arima_forecast

autoplot(ot_arima_forecast)Root Mean Square Error

getrmse <- function(x,h,...)

{

train.end <- time(x)[length(x)-h]

test.start <- time(x)[length(x)-h+1]

train <- window(x,end=train.end)

test <- window(x,start=test.start)

fit <- Arima(train,...)

fc <- forecast(fit,h=h)

return(accuracy(fc,test)[2,"RMSE"])

}

getrmse(data_ts,h=24,order=c(3,0,0),seasonal=c(2,1,0),lambda=0)

getrmse(data_ts,h=24,order=c(3,0,1),seasonal=c(2,1,0),lambda=0)

getrmse(data_ts,h=24,order=c(3,0,2),seasonal=c(2,1,0),lambda=0)

getrmse(data_ts,h=24,order=c(3,0,1),seasonal=c(1,1,0),lambda=0)

Output Screenshots of ARIMA Model

ARIMA model for exponential series

Plots of Forecasts from ARIMA

Augmented Dickey-Fuller Test

Augmented Dickey-Fuller Test

Forecast ARIMA(2,1,0)

RMSE

Comparision of Accuracy of All Models

Accuracy of Simple Exponential Smoothing

Accuracy of Holt’s Method

Accuracy of Holt’s Winter Method

Accuracy of ARIMA for Exponential Series

Accuracy of AUTO-ARIMA Model